Chase Sapphire Reserve Requirements For Approval

The chase sapphire reserve has slightly stricter approval requirements than its little brother the chase sapphire preferred card.

Chase sapphire reserve requirements for approval. Although the chase sapphire preferred is considered a great beginner card and is easier to be approved for than the chase sapphire reserve y ou re not likely to get approved if you re just starting out or only have one credit card to your name. Unless you have been living under a rock you are likely aware of the chase sapphire reserve. Your chase sapphire reserve account must be open and not in default to maintain subscription benefits. Chase will usually pull your credit report from a couple of the three credit bureaus equifax experian and transunion your scores may be different across each bureau.

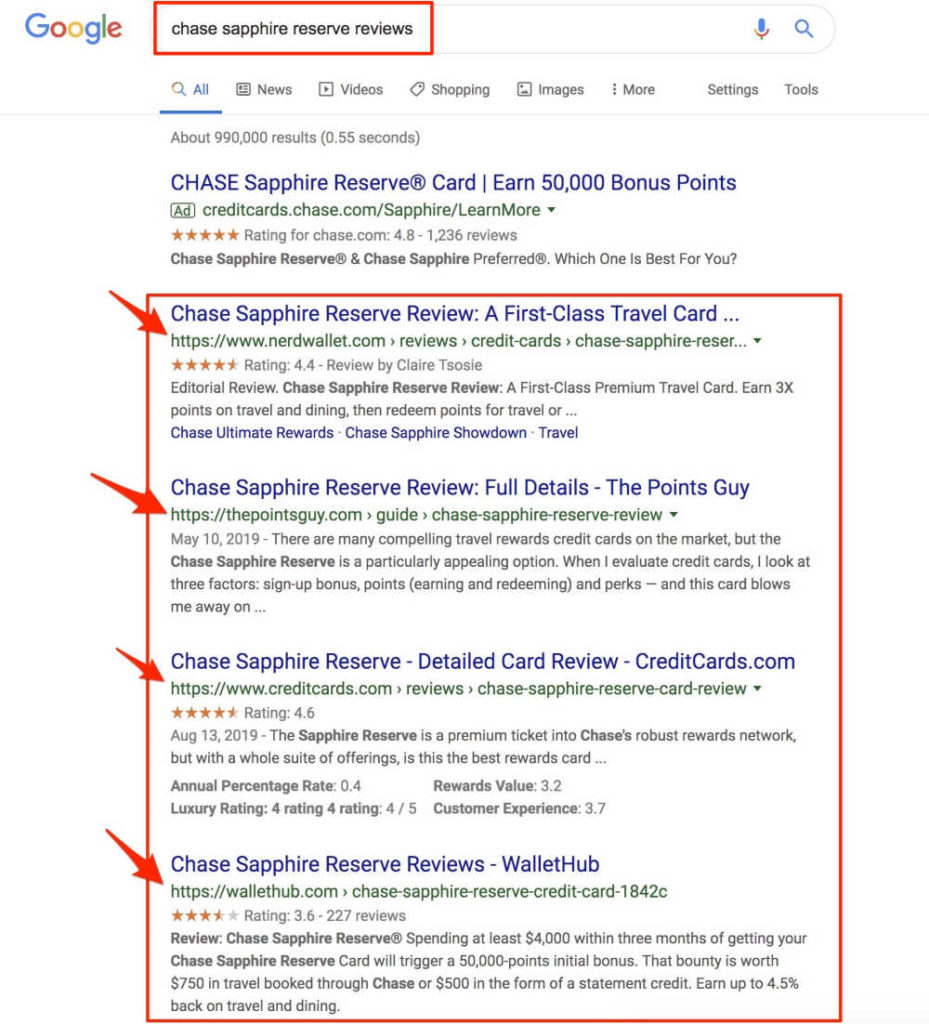

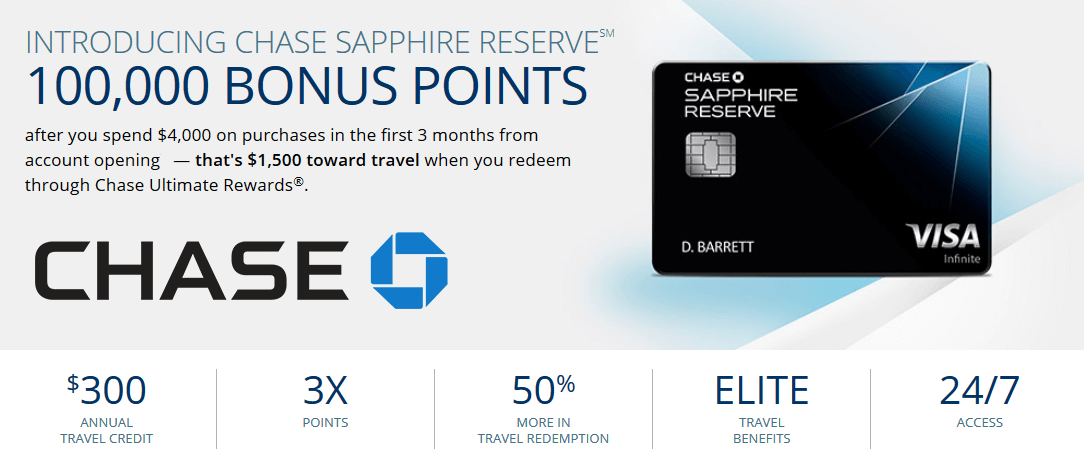

With a welcome bonus of 50 000 chase ultimate rewards points worth 750 in travel booked through the chase portal after meeting minimum spending requirements plus a slew of benefits that can save you money and give you peace of mind. If anything the former condition may vary some cardholders did report being approved with sub 750 scores after all but the latter condition has very little flexibility. I d recommend applying for one of these cards first if you re just starting to build. The chase sapphire reserve is incredibly popular for good reason read our chase sapphire reserve review.

The chase sapphire reserve credit score requirement is 750. Reports suggest that you ll typically need a score of at least 720 to get approved for the card though the average score is a bit higher. Unfortunately even if you have an excellent credit score a perfect credit history and a high income you are not by any means guaranteed to be approved for the sapphire reserve if you ve added. Earn up to 120 in statement credits on qualifying doordash purchases through 12 31 2021 that s 60 in statement credits through 12 31 2020 and another 60 in statement.

Earn up to 120 in doordash statement credits through 12 31 2021. In general it seems that getting approved for the chase sapphire reserve requires both excellent credit and coming in under the 5 24 rule s limits. It s a premium travel rewards card with a 550 annual fee. Consider these factors to help improve your chase sapphire reserve approval odds.

It s a premium travel rewards card with a 550 annual fee. Chase says this card is for people with excellent credit the highest tier in the credit score range and while excellent credit is generally thought to start at 720 we really recommend a credit score of 750 to maximize your chances of approval. You typically need an excellent credit history and high income. Factors that chase considers.

The sapphire reserve is an exceptional rewards card.

/chase_sapphire_reserve_FINAL-10928ca829154185a836f5ce7edd8183.png)